Funded Private Mortgages

Income for Ben’s Clients vs Public Investments

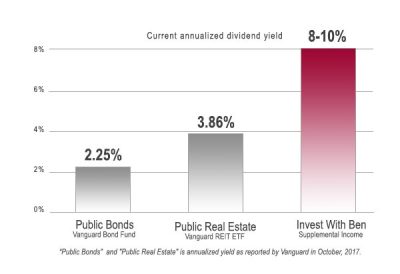

Ben’s private mortgages offer security and a higher annual income than other secure public income-focused investments. Furthermore, because our company purchases properties at significant discounts, we are able to add another layer of collateralized protection on your investment.

The figure shown here represents the minimum annual income yield when clients invest in Ben’s mortgages and how that compares to other public investment options that provide the same security as Ben’s mortgages.

To learn more about how we beat the indices, read our Private Lending Guide.

FUNDED

Property Address:

1516 W Edinburgh Bend, Bloomington, IN 47403

Investment: $169,000

Yield: 8%

Lien: 1st

Term: 6 months

FUNDED

Property Address:

9678 Trail Dr, Avon, IN 46123

Investment: $147,000

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

3307 Houston St, Indianapolis, IN 46218

Investment: $86,000

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

641 N Luett Ave, Indianapolis, IN 46222

Investment: $39,000

Yield: 10%

Lien: 1st

Term: 60 months

FUNDED

Property Address:

5040 W Troy Ave, Indianapolis, IN 46241

Investment: $98,000

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

603 W Main St, Lebanon, IN 46052

Investment: $102,000

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

5135 W North County Line Rd, Clayton, IN 46118

Investment: $185,000

Yield: 8%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

10875 Cedar Pine Dr, Indianapolis, IN 46235

Investment: $72,000

Yield: 9%

Lien: 1st

Term: 60 months

FUNDED

Property Address:

10948 Muddy River Rd, Indianapolis, IN 46234

Investment: $145,000

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

10602 Scotwood St, Indianapolis, IN 46234

Investment: $170,500

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

5538 Pilgrim Dr, Indianapolis, IN 46254

Investment: $117,000

Yield: 9%

Lien: 1st

Term: 60 months

FUNDED

Property Address:

8888 Sundrop Rd, Indianapolis, IN 46231

Investment: $138,500

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

1756 E Tabor St, Indianapolis, IN 46203

Investment: $75,000

Yield: 9%

Lien: 1st

Term: 60 months

FUNDED

Property Address:

1429 N Butler Ave, Indianapolis, IN 46219

Investment: $108,000

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

12588 Tennyson Ln Apt 103, Carmel, IN 46032

Investment: $113,300

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

1918 Gilmore St, Columbus, IN 47201

Investment: $117,000

Yield: 9%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

4567 Carrollton Ave, Indianapolis, IN 46205

Investment: $127,000

Yield: 10%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

824 Noble St, Indianapolis, IN 46203

Investment: $267,000

Yield: 9%

Lien: 1st

Term: 6 months

FUNDED

Property Address:

6112 E 169th St, Noblesville, IN 46062

Investment: $148,000

Yield: 8%

Lien: 1st

Term: 12 months

FUNDED

Property Address:

561 E 107th St, Indianapolis, IN 46280

Investment: $150,000

Yield: 8%

Lien: 1st

Term: 24 months

FUNDED

Property Address:

7135 Long Shore Circle, Indianapolis, IN 46217

Investment: $82,000

Yield: 8%

Lien: 1st

Term: 12 months

Funded Private Mortgages in Indianapolis: A Gateway to Real Estate Opportunities

As the Indianapolis real estate market thrives, private mortgage lending emerges as a pivotal player, offering a plethora of opportunities for investors with an eye for potential. Funded private mortgages are an innovative alternative to traditional bank loans, providing an attractive investment strategy with a promise of robust returns.

Understanding the Fundamentals of Private Mortgages

At their core, private mortgages are loans secured by real estate, supplied by individual investors rather than banking institutions. The appeal of these private mortgages in Indianapolis lies in their flexibility and potential for higher yields. For borrowers who may not meet the stringent requirements of traditional lenders, private mortgages represent a viable and often advantageous option.

The Benefits of Investing in Private Mortgages

Investing in funded private mortgages in Indianapolis comes with several key benefits. The possibility of higher returns compared to standard investment channels stands out as a primary advantage. Additionally, the inherent security backed by real estate assets lends a sense of security to investors, ensuring that their investments are protected.

Maximizing Returns with Strategic Mortgage Funding

The strategic funding of mortgages in the Indianapolis market requires a keen understanding of the local real estate landscape. By leveraging mortgage strategies tailored for Indianapolis investors, you can maximize your investment returns while mitigating risks. Such strategies involve a thorough analysis of market trends, property valuations, and borrower reliability.

Private Lending: A Path to Diversifying Your Portfolio

Diversification is a cornerstone of any sound investment strategy. Through private lending, investors can diversify their portfolios beyond traditional stocks and bonds. The Indianapolis market, with its dynamic growth in the real estate sector, presents a ripe landscape for such diversification. By offering funding solutions for various real estate projects, from commercial developments to residential flips, investors can spread their risk and tap into new revenue streams.

Real Estate Solutions and Opportunities in Indianapolis

Indianapolis is not just about funding; it's about finding real estate solutions that cater to a diverse range of needs. Whether it's providing capital for flipping houses in Indianapolis or supporting long-term residential developments, private mortgages are instrumental in propelling the property market forward. Investors have the opportunity to become part of innovative projects that shape the city's skyline and community.

Conclusion

The funded private mortgage scene in Indianapolis is vibrant and full of potential. For investors ready to delve into this market, the rewards can be significant. With a solid strategy, an understanding of the local market, and the right funding solutions, you can turn Indianapolis real estate investments into a substantial and fulfilling part of your investment portfolio.